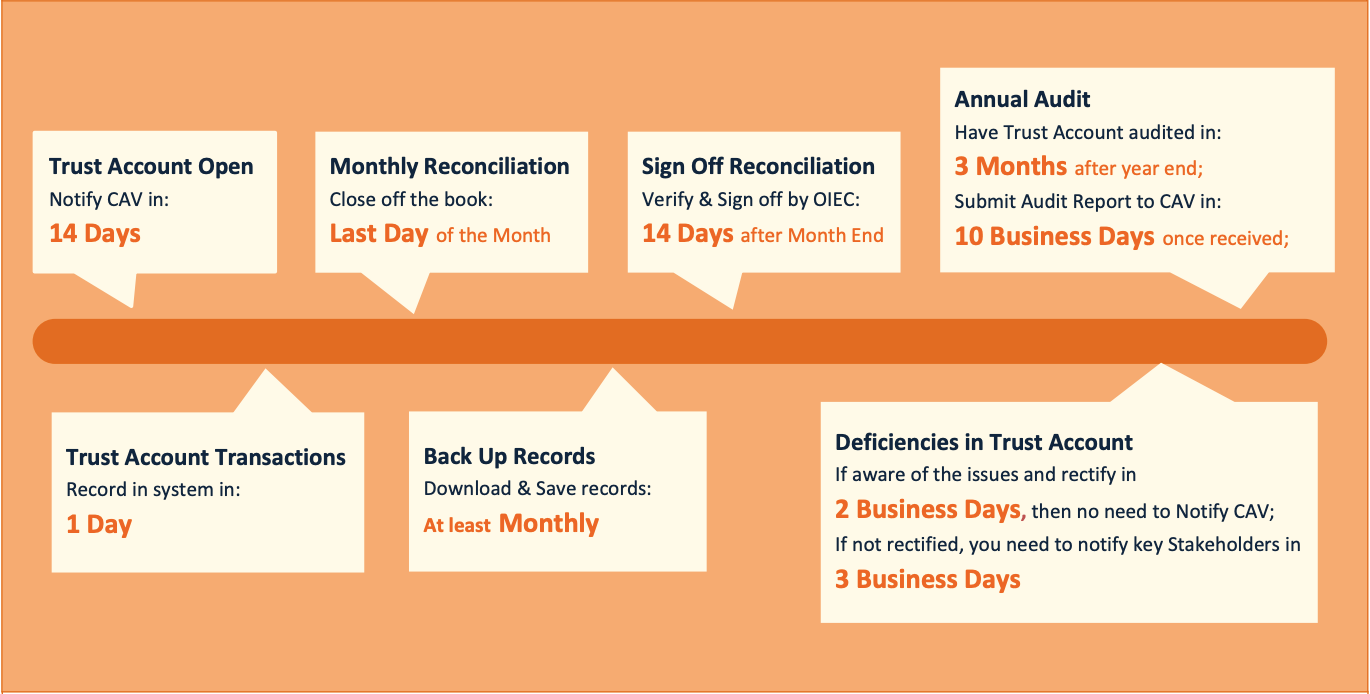

When it comes to trust accounting, we believe having the key due dates on your calendar should be your top priority. Develop your trust accounting policies and procedures for your team based on these deadlines will help you to avoid any unnecessary audits or investigations.

The trust accounting rules vary State to State. In this article, we are focusing on the Victorian rules.

Opening a Trust Account

You need to notify Consumer Affairs Victoria (CAV) via myCav within 14 Days after the trust account is opened. Do take note that it is 14 days and not 14 business days.

Trust Account Transactions

Receiving money for or paying from the trust account? You need to maintain all relevant records such as receipt number, date of receipt, amount and etc. on a daily basis. On top of that, you are required to update your accounting records by the end of the next business day. Therefore, we suggest the best practice is to record transactions on a Daily basis.

Monthly Reconciliation

Close off the month at the end of the month. When we say the end of the month, we mean the Last Day of the month, not 27th or 28th or the last working day. The Estate Agents (General, Accounts and Audit) Regulations 2018 Regulation 26 does not mention anything about exemptions if the last day of the month falls over the weekend.

Is that it? Definitely not. The Officer in Effective Control (OIEC) need to verify the reconciliation statement as true and accurate within 14 Days after the end of each month and sign off for audit trail. Once again, this is not 14 business days so please do not leave it to last minute.

Back Up of Records

You are required to back up electronic records at least once a month and have it stored at a separate location. While many rely on the trust accounting software, a reminder that the software provider is not the license holder. We suggest to check your software provider’s policy on back-up and recovery. Ideally, you should have your own back up as well. The legal requirement is to keep these documents for at least seven years; paper or electronic form.

Deficiencies in a trust account

Most trust accounting software now will not allow any transaction causing a debit (negative) balance in the trust account. However, do not forget that if you are aware of deficiency in the trust account, you will have to rectify within two business days, otherwise you need to notify CAV, the agency director and your auditor within the next business day.

Annual Audit

You must have the trust accounts audited within three months after the financial year end 30 June. Note that the financial year for audit is for the period 1 July to 30 June per the normal circumstances. However, you can vary the trust account audit date if you have a substituted accounting period for the entity. Once the auditor issued their audit report, you must lodge a copy with CAV via myCav within 10 business days.

For agency that has cease operations, you will be lodging a final audit report. Remember that you must notify CAV in writing within 28 days and the trust accounts must be audited within three months after cessation.

Speak to us

We hope we have given you a good concise summary of the key timelines. To make it even better, we have prepared a pictorial timeline below for you too.

We would like to speak to you and assist if you have any questions or concerns. Contact us now for your complimentary and no obligation first meeting to discuss on how we can assist you to comply with your Trust Accounting compliance.

18 September 2020 © AscendPoint 2020

Disclaimer

This publication is intended as a general commentary only and does not purport to be comprehensive. It should not be regarded as tax advice and you should not act solely on the information contained herein. Please contact us to further discuss about your circumstances or concerns.

Liability limited by a scheme approved under Professional Standards Legislation